WHERE NORWEGIAN Gas IS Offered

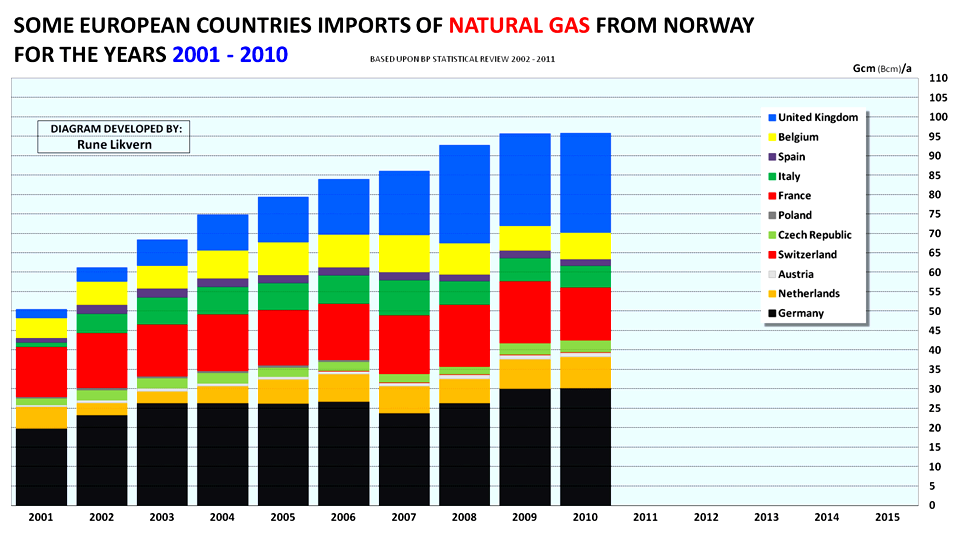

Figure 02: The figure above shows the annual developments in Norwegian gas deliveries (for that years 2001 to 2010) and imported volumes by a few countries.

- Norwegian delivered near to 100 Bcm of gas this year and many of their gas is offered and sent to customers in Europe (that’s, Continental Europe and also the United kingdom).

- By 2011, Norwegian was the world’s second largest exporter of gas after Russia.

- Around 95% of Norwegian gas sales are delivered by pipelines and also the balance by liquefied gas (LNG).

- Development in Norwegian gas sales publish-2005 has mainly visited the Uk, and through 2010 Norwegian provided the United kingdom with roughly 28% of gas consumed in the united states.

Just A Little ON SHRINKAGE AND DOMESTIC USES

The observant readers may have observed that offered and delivered gas volumes as proven in Figure 2 are slightly under exactly what the NPD has reported as created as proven in Figure 1.

NPD reports gas volumes metered and delivered from plants. These volumes, that are thought to include gas fluids [NGL mainly ethane (C2H6), lp (C3H8) and butane (C4H10)], are within the gaseous condition at normal pressure and temperature. The gas that is offered is principally methane (CH4).

NGLs are frequently known as "canned gas", as gas fluids after extraction and fractionation (as performed at Kårstø and Kollsnes), are offered and delivered pressurized within the liquid condition. Extraction and fractionation of NGLs shrink the quantity of gas volumes delivered in the plants and therefore lower sales gas volumes as well as their volumetric energy content.

The NGL extraction process is needed to satisfy gas specifications in the buyers and pipeline operators.

For 2011, it’s believed this shrinkage amounted to greater than 4 billion cubic meters (Bcm), or about 4% of total reported amount of gas metered and delivered in the plants.

Norwegian uses little gas domestically (around 2% of annual production). It’s employed for power generation in the plants, elevated oil recovery (Grane), feed for that methanol plant at Tjeldbergodden, as well as for power plants and supplies to households and industries in Haugesund and Stavanger.

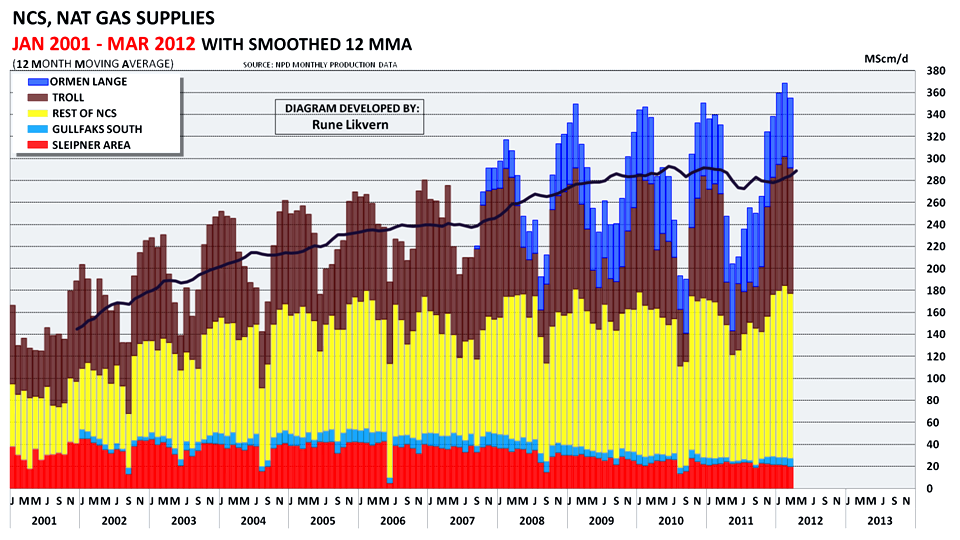

Figure 03: The figure shows actual total gas production split by a few major fields and categories of fields from The month of january 2001 to March 2012. The figure relies upon monthly NPD data.

A one year Moving Average (12 MMA)black lines are incorporated within the chart. In The month of january 2012, Norwegian gas production arrived at a brand new monthly high. NOTE: The chart shows production per calendar day, thus variations in flows in one day-to another are common.

The chart above also illustrates the periodic variations in buyers’ nominations for Norwegian gas. The chart illustrates that in recent winters two fields, Ormen Lange and Troll, taken into account around 50% from the total Norwegian gas deliveries. Most Norwegian gas is offered under lengthy term contracts.

In The United States, gas production is susceptible to less periodic variations than in Europe. In The United States, periodic variations sought after are usually included in storage withdrawals/injections. In Europe periodic variations will be to a bigger extent included in a mix of storage withdrawals/injections and much more production elasticity designed in to the production installations and pipelines.

For The month of january 2012, the NPD reported Record gas sales in The month of january, which assists the forecast proven in Figure 1.

R/P AT Finish 2011 And Just What IT SUGGESTS FOR FUTURE PRODUCTION

The ratio for Reserves over-production, (R/P), can be a useful parameter in perceiving future production developments. A minimal R/P ratio shows that production can be expected to say no along with a high R/P suggests production levels might be sustained or perhaps grow.

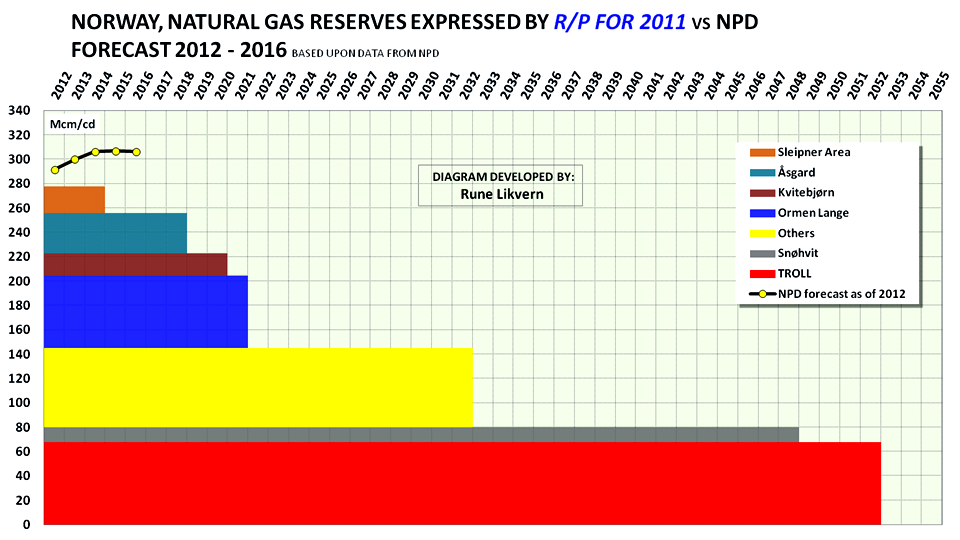

Figure 04: The figure shows the time period of manufacture of gas from fields and categories of fields around the Norwegian Continental Shelf (NCS) by making use of the R/P ratio at year-finish 2011. Within the real life the development won’t consume a rectangular profile (although it might be desirable for economic reasons).

As reservoirs deplete they’ll sooner or later (for gas normally around 70 – 80% depletion) notice a lack of productive potential and follow an exponential decline. The figure also shows the NPD’s recent forecast for that years 2012 to 2016. The figure is dependant on reserve estimates and production data in the NPD in the finish of 2011 and includes all fields being produced and under development, like Gudrun, Gaupe, Skarv, Valemon, and Martin Linge.

NOTE: The figure shows production per calendar day.

The R/P rectangles above have different levels of elasticity and a few fields had greater productive potential than buyers requested for throughout the gas year 2010 (the gas year starts in October which last through September the year after). The fields’ elasticity can also be associated with facilities constraints like liquefaction (LNG) convenience of Snøhvit by production and export capacities for Ormen Lange (that could be upgraded if new fields are arrived at Nyhamna) by treatment capacities at Kollsnes for Kvitebjørn and Troll.

Based on NPD data, the Sleipner area had an R/P close to 2.7 by finish of 2011, which shows that the development in the Sleipner area is going to enter a high decline.

The Åsgard fields and then Kvitebjørn are anticipated to become susceptible to declines within their productive capacities within the next couple of years because these fields still deplete.

Kollsnes (Troll and Kvitebjørn) and Ormen Lange are supplying the majority of the swing production for periodic demand. This leaves mainly other fields (see Others in Figure 3) as sources for just about any near term development in gas production in the NCS.

As Figure 3 illustrates, Others has, recently, paid for the declining production in the Sleipner area. Phone R/P ratios for that fields and number of fields shows when new developments are scheduled to begin flowing, as well as their expected production levels leaves little expectation for a rise in total production. For the long run, it’s now expected that Others will mainly make amends for declining production from aging and depleting fields.

Figure 4 using the R/P ratios shows that the development from NCS could grow during 2012 in accordance with 2011 which the development then may stick to a plateau towards 2015/2016 before it goes into a high decline towards 2020 and beyond, as proven in Figure 1.

Breakthroughs Within The NORWEGIAN Ocean IN Planning DEVELOPMENT

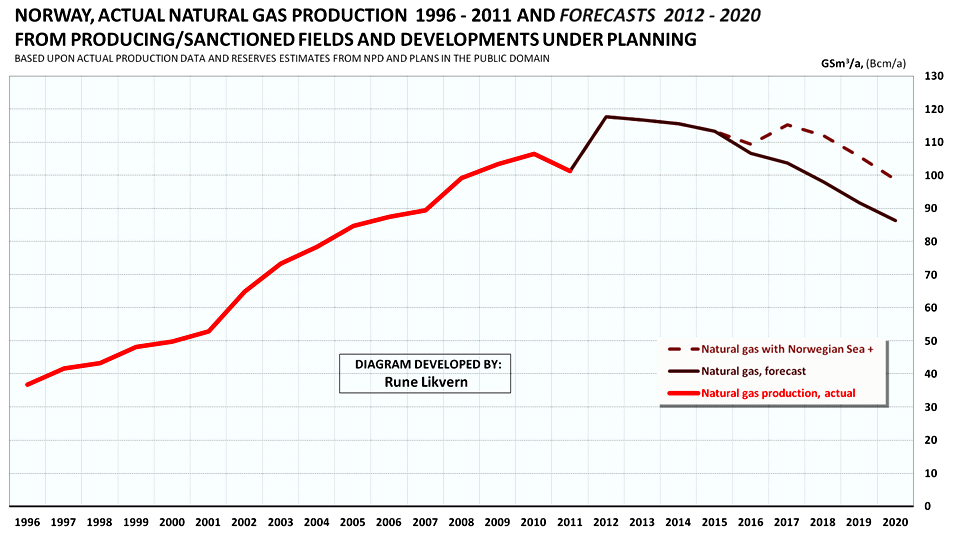

Figure 05: The chart shows actual manufacture of Norwegian gas (thick red line), a forecast towards 2020 for creating and sanctioned developments (thinner deep red line) along with a forecast for fields within the Norwegian Ocean (Aasta Hansteen, Linnorm and 6506/6-1, dashed deep red line) in planning and scheduled to begin flowing late 2016.

Plans now demand multiple coordinated field developments within the Norwegian Ocean to allow a trunk line NSGI (Norwegian Ocean Gas Infrastructure) to Nyhamna (receiving facility for that Ormen Lange and start of Langeled pipeline).

The fields which are now considered for rise in the Norwegian Ocean are Aasta Hansteen (formerly Luva) 46 Bcm (Billion cubic meters), 1.300 meters water, Linnorm, 24 Bcm and 6506/6-1, 27 Bcm.

These 3 breakthroughs are actually believed to carry as many as 100 Bcm of recoverable gas, addressing exactly the same volume that Norwegian presently exports which the United kingdom consumes yearly.

These fields within the Norwegian Ocean may extend the plateau for total Norwegian gas deliveries by two to three years, (make reference to Figure 5).

Based on openly available data it’s been believed that Aasta Hansteen includes a breakeven cost of just one.60 – 1.70 NOK/Scm (.50 to .55 p/therm) at delivery points like NBP (National Balancing Reason for Heeren) within the United kingdom or maybe associated with the united states market, $8.00 – $8.50/Mcf at Henry Hub.

This serves for instance of the items cost buyers may expect for future resources of Norwegian gas from new developments.

The chart in Figure 5 also illustrates that because this decade involves an finish it might be harder to sustain the plateau for gas deliveries in the NCS, and that the developed breakthroughs are usually smaller sized and therefore possess a short plateau and many likely steep decline rates.

Resourse: http://theoildrum.com/node/

How To Make The Easiest And Best Oil Barrel Barbecue Ever! (No Welding)

Video COMMENTS:

Graham R Dyer: Real people at last.

Jamila Yahiaouiهمخهظظمن: عصام طباع

Nelson Castro Ojeda: +Jamila Yahiaouiهمخهظظمن soineln

Yer Man: 10w40 is the new Olive Oil. \n\nGreat vid, thanks.

Lourdes Siglos: bayot ka

Byron Delgado: lol

Brian Williams: you live the way I hope to one day. Just gotta save enough money for a plot of land. Cheers!

Maduka Jayalath: good luck bro!

Brenden Hinds: Way Out West Blow-in blog \nK \nHow to make a smoker

Yub Kim: oh my god where do you live? your life style seems so romantic and everybody seems so happy! I wish I can be a part of your community.